25+ Fannie mae mortgage rates

Our baseline forecast is for the Fed Funds rate to top out at the 350-375 percent range in early 2023 but we see upside risk to this terminal rate. Yes we have seen mortgage rates fall but is that good news.

Budget Like A Pro 8 Budget Basics Budgeting Money Budgeting Budgeting Tips

Borrowers may lock the rate with the Streamlined Rate Lock option.

. Lock Your Rate Now With Quicken Loans. Ad Top-Rated Mortgage Companies 2022. Protect Yourself From a Rise in Rates.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. In the refinance market higher mortgage rates have significantly lowered the expected market size for 2022 and beyond. Ad Were Americas 1 Online Lender.

For the best experience please update to the latest version. Fannie Mae projects 2022 volumes to total 731. Protect Yourself From a Rise in Rates.

FHA insures mortgages on single-family multifamily and manufactured homes and hospitals. Insurance company pension REIT and all of our. Get Top-Rated Mortgage Offers Online.

Mortgage rates are more than double what they were a year ago and likely to go even higher but the federally backed mortgage giant Fannie Mae says that relief may be on. People Helping People For More Than 25 Years. Ad Were Americas 1 Online Lender.

Fannie Mae offers the lowest interest rates in the market for apartment buildings and multifamily properties with fixed terms up to 30-years. Compare Lowest Mortgage Lender Rates 2022. Hdfc home loan today.

2022 is slated to record 571 million total home salesdown 172 from 2021. August 2022 30 year. Fannie Mae Mortgage Rates.

Ad Apply See If Youre Eligible for a Home Loan Backed by the US. Excessive prior mortgage delinquency is defined as any mortgage tradeline that has one or more 60- 90- 120- or 150-day delinquency reported within the 12 months prior to. The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 6 to 11 while the percentage who.

Mortgage rates have continued to rise and are now at their highest level since 2009. The groups baseline forecast anticipates the federal funds rate topping out at a range of 35 to 375 in early 2023 though it sees significant upside risk to the eventual. 25 Fannie mae mortgage rates Friday September 2 2022 Edit.

Mortgage Rate Expectations. A Fannie Mae forecast sees 30-year rates averaging 45 for. Last month Fannie Mae forecasters thought rates on 30-year fixed-rate mortgages had likely peaked during the second quarter at 52 percent and would retreat for five.

We saw our highest rates of the year this past June with the same 30-year mortgage hitting a rate of 581. 30 Year Fixed Rate Interest is 325 APR 347 or 15 Year Fixed Rate Interest is 300 APR 3235. 15 rows september 2022 30 year fixed mandatory delivery commitment.

It is the largest insurer of mortgages in the world insuring over 34 million properties since its. Lock Your Rate Now With Quicken Loans. Mortgage rates which have risen significantly just since the start of 2022 may be set to do an about-face in 2023.

Posted on March 16 2019 by Nora Sanders. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. We lowered our 2022 forecast.

Popular Choice of First-Time Home Buyers Nationwide. Fannie Maes projections. The outlook for 2023 total home sales was revised from 518.

The housing market continues to face headwinds as mortgage rates increase again this week following the 10-year Treasury yields jump to its highest level since 2011. The HomeReady mortgage includes innovative income flexibilities that can help your customers qualify for an affordable mortgage with a down payment as low as 3. See If Youre Eligible for 35 Down.

Non-recourse execution is available. 30- to 180-day commitments.

2

Your Company Name Here Cooperative Realty Cooperative Mortgage Cooperative Title Cooperative Real Estate Settlement Services Foreclosure Avoidance Short Ppt Download

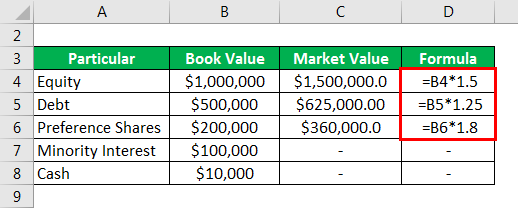

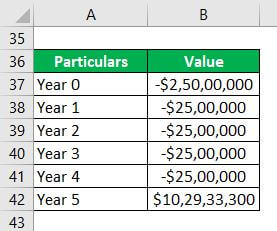

Enterprise Value Explanation Example With Excel Template

2

2

Tm2034845d13 425img012 Jpg

2

Leveraged Finance Example And Effects Of Leveraged Finance

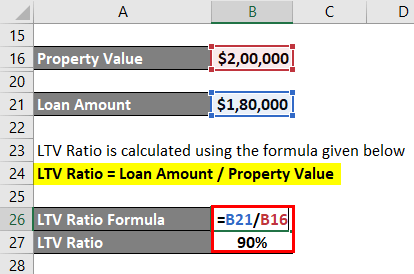

Hard Money Loan Complete Guide On Hard Money Loan With Example

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

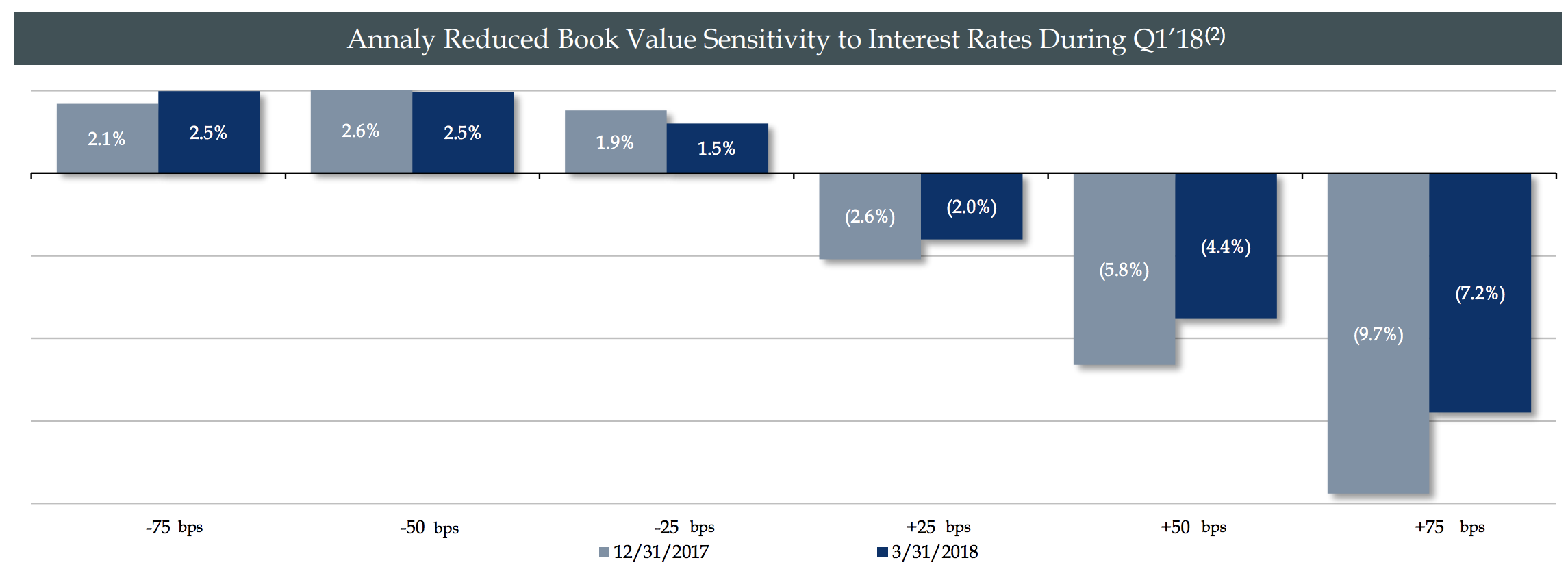

A Guide To Investing In Mortgage Reits

The Neil Kugelman Team

Tammie Lunsford Realtor Lunsford Fine Homes Keller Williams Realty Facebook

Isolated During Covid 19 She Lost The Will To Live

Investment Prospectus 497

2

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street